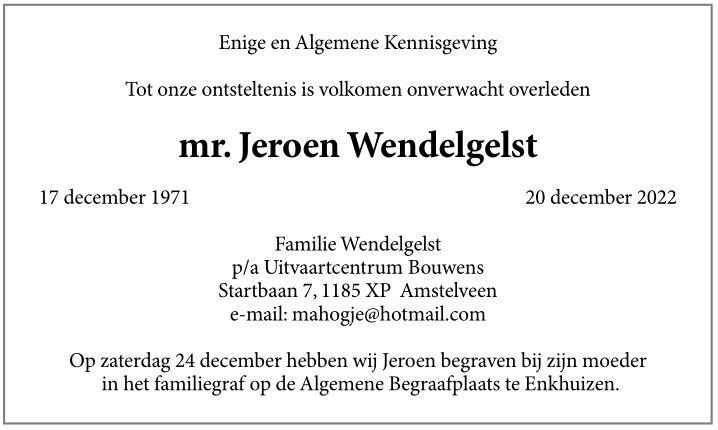

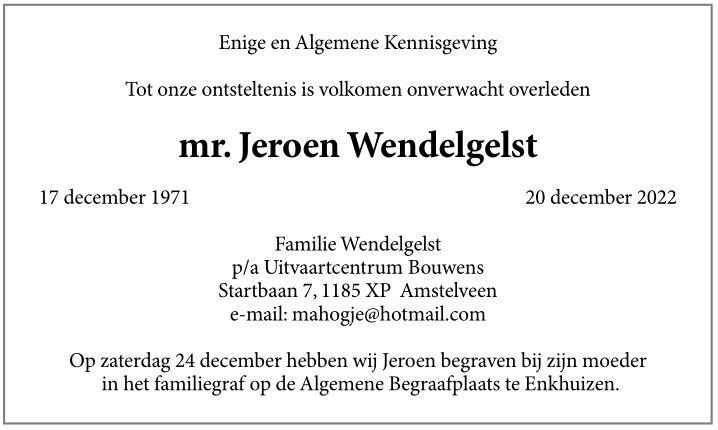

Vanwege het overlijden van Jeroen Wendelgelst (1971-2022) is de website offline en de onderneming beëindigd. Er zal niet meer worden gereageerd op email.

Vanwege het overlijden van Jeroen Wendelgelst (1971-2022) is de website offline en de onderneming beëindigd. Er zal niet meer worden gereageerd op email.